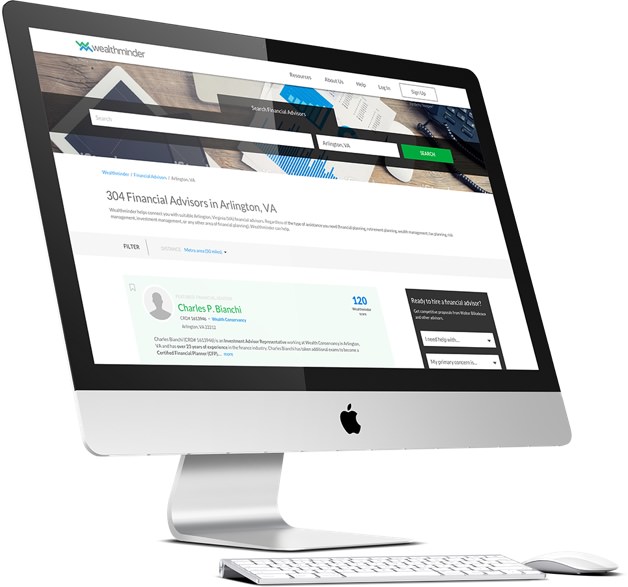

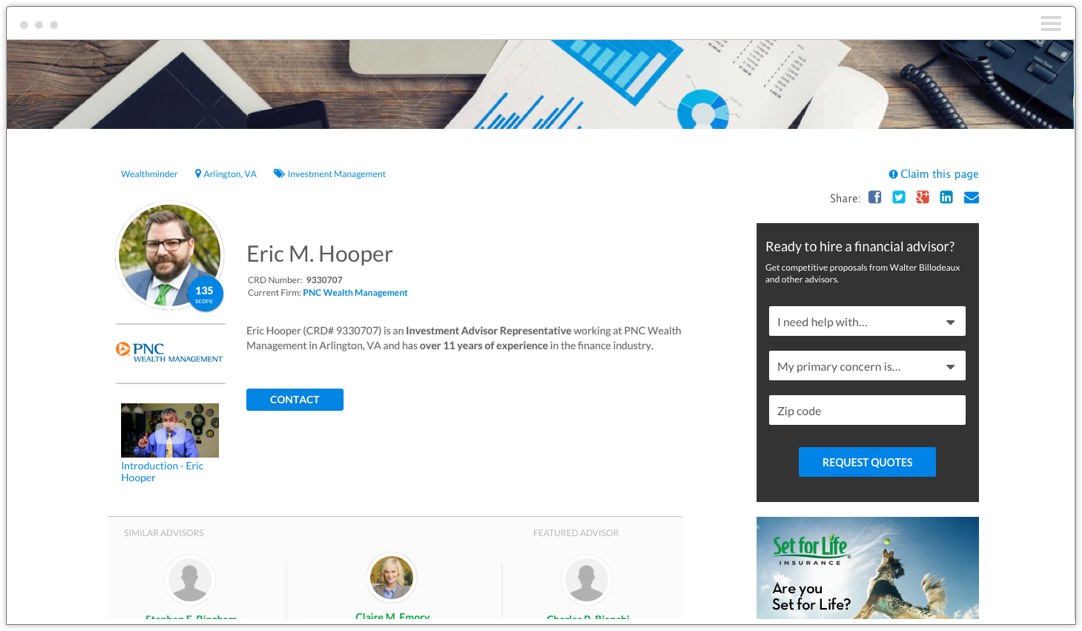

Wealthminder helps you tap into the 100 million customers you can't service today

If you're like most financial advisors, your days are busy. Clients have questions, financial plans require updating, compliance matters need your attention, and a constant stream of information on financial markets, planning approaches and changing regulations all compete for your attention. You want to grow your client base, but how do you find the time to focus on marketing and making new connections with so many other demands on your time?